The Good, the Bad, and the Taxable: 10 OBBBA Updates You Should Know.

- Tyler Weerden

- Jul 19, 2025

- 24 min read

Updated: Jul 20, 2025

The One Big Beautiful Bill Act became law on July 4, 2025. If you’d like to casually browse the final version of the bill, there’s an easy-to-read 330-page PDF you can download (sarcasm intended).

Fortunately, the major changes to federal employee benefits that were proposed did not survive. The elimination of the Retiree Annuity Supplement, switching from high-3 average salary to high-5 when computing your pension, and increased deductions from your paycheck for retirement contributions were all eliminated from the final version of the bill.

Some provisions will affect all taxpayers, while others will only affect those with children, owners of real estate, individuals over 65, new car buyers, etc.

Article Quick Links

3 administrative notes.

Admin Note 1: This is NOT a political article. I am not arguing for or against the passage of the bill. We are simply covering the numbers and how they may impact you and your family.

Admin Note 2: Anytime I write “permanent”, please understand that this means “permanent” in the context of legislation. When the next bigger, more beautiful bill is passed, some of these “permanent” things may change.

Admin Note 3: This bill frequently references Modified Adjusted Gross Income (MAGI). Unfortunately, there are many different IRS MAGI calculations used for different reasons. For many of the OBBBA provisions, MAGI equals:

(1) Adjusted Gross Income (W2 income, interest, dividends, IRA distributions, pension income, Social Security, capital gains, rental income, business profit, etc.)

(2) Plus amounts you excluded under Foreign Earned Income Exclusion (FEIE) & Foreign housing costs (26 U.S. Code § 911)

(3) Plus amounts you excluded as income from sources within Guam, American Samoa, or the Northern Mariana Islands (26 U.S. Code § 931)

(4) Plus amounts you excluded as income from sources within Puerto Rico (26 U.S. Code § 933)

For many simple taxpayers, MAGI = AGI (line 11 on the 1040). However, for Foreign Service personnel who have a spouse claiming FEIE, your MAGI may not be the same as AGI on line 11.

As always, I am a financial planner but I am not your financial planner. I am not an accountant and this article is by no means tax advice. Consult with a professional before making financial, tax, and legal decisions.

(1) HIGHER STANDARD DEDUCTION

Section 70102

Effective for tax year: 2025

Expires after tax year: Permanent

When figuring out your total federal taxable income for the year, the government lets you deduct a standard amount, known as the standard deduction. If you have itemized deductions that total more than the standard deduction, you can itemize your deductions on Schedule A and deduct that higher amount.

Itemized deductions generally include state & local tax (SALT), mortgage interest, charitable contributions, medical / dental expenses above a certain threshold, and casualty and theft losses from a federally declared disaster.

You can see in the table below, before the Tax Cuts & Jobs Act (TCJA) was signed into law in 2017 (effective 2018), the standard deduction was roughly half of the post-TCJA amount.

When the standard deduction was lower, more people itemized deductions. Generally speaking, itemizing results in more complex tax returns. According to the IRS, for tax year 2016, 68.6% of filers used the standard deduction. In 2017, 68% of filers used the standard deduction. Post-TCJA, this jumped to 87.3% in 2018 and the latest data from tax year 2021 shows that 88.2% of returns used the standard deduction. With OBBBA, I would expect this number to remain high.

This increased standard deduction was scheduled to “sunset” or expire in 2026. The OBBBA makes the higher standard deduction permanent, and even increased the 2025 amounts. The higher standard deduction will now be adjusted annually for inflation.

Why does this matter?

Let’s break it down with an illustration from a portion of the Form 1040 (U.S. Individual Income Tax Return).

Line 11 – Adjusted Gross Income: This is the total of your W2 income, interest, dividends, capital gains, pension, IRA distributions, taxable portion of Social Security, etc. When calculating line 11, there are some “additional income” items (e.g., rental income, business income, gambling winnings, prizes, etc.) that may increase line 11. There are also some “adjustments to income” (e.g., HSA contributions, IRA deductions, student loan interest, etc.) that may reduce line 11. Once the "additional" items from line 8 and the "adjustment" items from line 10 are calculated, we have adjusted gross income on line 11.

Do you want to pay tax on the total amount on line 11? Wouldn’t it be nice to take a chunk of that money and make it disappear, reducing your tax burden?

Introducing line 12.

Line 12 – Standard deduction or itemized deductions. The number on line 12 is subtracted from line 11 (AGI), and then flows down to line 15 to determine your "taxable income". For simplicity’s sake, we’re going to ignore the Qualified Business Income Deduction (QBID) on line 13.

Big picture: All else being equal, a higher standard deduction (line 12) = less taxable income (line 15).

(2) TAX BRACKETS WILL NOT EXPIRE

Section 70101

Effective for tax year: 2026

Expires after tax year: Permanent

Scheduled tax bracket increases will not occur. Like the standard deduction, the lower federal tax brackets enacted under the Tax Cuts & Jobs Act (TCJA) were set to “sunset” / expire as of 1/1/2026.

The OBBBA makes these lower tax brackets permanent.

All else being equal, this means you’ll be in a lower tax bracket than you would have been if the current brackets expired (except for 10% and 35% which were in effect pre-TCJA and post-TCJA / OBBBA).

A quick note on our tax system since this is frequently misunderstood. If you are in the 22% tax bracket you do not pay 22% tax on each dollar.

Our federal income tax system is progressive, so your tax rate increases as your income increases.

Consider a single filer with $60,000 federal taxable income (after the standard or itemized deductions).

The first $11,925 is taxed at 10% = $1,192.50 tax due

The next $36,550 ($11,926 - $48,475) is taxed at 12% = $4,386 tax due

The next $11,525 ($48,476 - $60,000) is taxed at 22% = $2,535.50 tax due

The total federal tax due is $8,114. If you actually paid 22% on all $60,000, you would have to pay $13,200 in tax.

That means this individual is in the 22% marginal bracket but paid an effective federal tax rate of 13.52% ($8,114 / $60,000).

Before the Tax Cuts & Jobs Act (TCJA) was signed in 2017, the federal tax brackets were:

10%, 15%, 25%, 28%, 33%, 35%, and 39.60%

After the Tax Cuts & Jobs Act (TCJA) became effective, the federal tax brackets changed to:

10%, 12%, 22%, 24%, 32%, 35%, and 37%.

10% vs 10%

12% vs 15%

22% vs 25%

24% vs 28%

32% vs 33%

35% vs 35%

37% vs 39.60

These lower brackets under TCJA / OBBBA generally result in you paying less tax when comparing the same income, deductions, credits, etc. (except for those in the 10% and 35% bracket). For example, if you and your spouse file Married Filing Jointly and had $150,000 of taxable income, you would have been in the 25% bracket pre-TCJA. Post-TCJA, and with the passage of the OBBBA, you’ll be in the 22% bracket.

(3) SALT LIMIT INCREASE

Section 70120

Effective for tax year: 2025

Expires after tax year: 2029

This is not a section of the bill allowing higher sodium intake. What we’re talking about is State and Local Tax (SALT), typically in the form of income and property tax.

Let’s take a trip back to the old standard deduction vs. itemized deductions that we talked about at the top of the article. One of the itemized deductions on Schedule A that may help you surpass the standard deduction amount is SALT.

Under the prior law, the maximum amount of SALT you could add on your Schedule A was $10,000. If you paid $15,000 in state income tax and local property tax, too bad, you were stuck with the lesser $10,000 deduction, essentially throwing away the other $5,000.

Take a look at "Taxes You Paid" on Schedule A for 2024. Notice it says add up all of your SALT (5d), but, “enter the smaller of line 5d or $10,000”. This is where you were limited to the $10,000 SALT cap.

Under the OBBBA, the SALT limit has been increased from $10,000 to $40,000, and will increase by 1% each year. So, in 2026, the SALT limit will be $40,400.

For those who itemize, or are close to being able to itemize, this could be a big deal. Like most things in life, there are a few catches.

(1) This is only in effect from 2025-2029, in 2030 it goes back to $10,000.

(2) You must itemize deductions to take advantage of this.

(3) $40,000 is the limit, regardless of whether you file Single or Married Filing Jointly.

(4) The limit is reduced to $20,000 for those who file Married Filing Separately.

(5) There are income phase-outs.

INCOME PHASE-OUT

The amount of the reduction to your SALT deduction is 30% of the amount you’re over the threshold.

Single & MFJ: $500,000 MAGI threshold (set to increase annually with inflation until 2030).

Married Filing Separately: $250,000 MAGI threshold (set to increase annually with inflation until 2030).

Here's an example.

If a tax filer (single or MFJ) has $600,000 worth of income, they’re $100,000 over the $500,00 threshold. 30% of $100,000 = $30,000. The maximum SALT deduction of $40,000 is reduced by $30,000 for a final SALT deduction of $10,000. The income phase-out will not make the SALT deduction smaller than $10,000. Regardless of income level, $10,000 is as small as the SALT deduction will get.

(4) OVERTIME DEDUCTION

Section 70202

Effective for tax year: 2025

Expires after tax year: 2028

HOW MUCH?

For tax years 2025 – 2028, up to $12,500 worth of overtime for single tax filers, or up to $25,000 worth of overtime for those who file Married Filing Jointly (MFJ), may be deducted from federal income.

It’s important to know that we’re just talking about a federal income tax deduction. This deduction does not mean the overtime pay will be free from state tax or the 7.65% federal payroll / FICA tax.

You do not have to itemize deductions on Schedule A to take advantage of this deduction.

WHO QUALIFIES?

Since there were so many questions on this topic, I wrote a separate article just for this new provision.

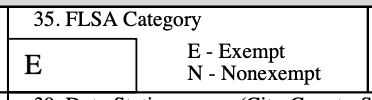

On 7/14/25, the IRS released guidance here. They confirmed that the overtime pay eligible for possible deduction is the “half” portion of “time-and-a-half”. If your regular pay rate is $20, and your OT rate is $30 (1.5 x 20), you would deduct the $10 amount over your regular rate. They also confirmed that the deduction can only be taken for overtime, “required by the Fair Labor Standards Act (FLSA).”

Therefore, it is my understanding that federal employees who are categorized as “FLSA exempt” will not be able to take any deduction.

If you are FLSA NON-EXEMPT, it appears that you may be able to deduct some overtime, based on the additional factors below.

Check your SF-50 to see what you're categorized as.

Section (e) for married individuals’ states that the overtime deduction can only be used if you file a joint return. This means individuals who file their taxes as Married Filing Separately (MFS) will not be eligible to deduct any overtime.

This is a “below-the-line” deduction, meaning it will still reduce taxable income, but won't reduce Adjusted Gross Income (AGI) on line 11 of the 1040. This means that other tax triggers centered around AGI (e.g., deductible medical expenses, Medicare Part B premiums, taxation of Social Security, traditional IRA deductibility, etc.) won't be affected by this deduction.

INCOME PHASE-OUTS

These deductible overtime amounts ($12,500 single & $25,000 MFJ) are phased-out once tax filers reach a certain level of Modified Adjusted Gross Income (MAGI). For simplicity’s sake, we’ll assume your MAGI = AGI (line 11).

“The amount allowable as a deduction shall be reduced (but not below zero) by $100 for each $1,000 by which the taxpayer's modified adjusted gross income exceeds $150,000 ($300,000 in the case of a joint return).”

What does that mean?

For every $1,000 you earn over the threshold ($150,000 single / $300,000 MFJ), the allowable overtime deduction is reduced by $100.

Single filers with MAGI at / above $275,000 get $0 overtime deduction.

Couples filing MFJ with MAGI at / above $550,000 get $0 overtime deduction.

(5) CHILD TAX CREDIT INCREASE

Section 70104

Effective for tax year: 2025

Expires after tax year: Permanent

OBBBA increases the Child Tax Credit (CTC) from $2,000 to $2,200 for qualifying children under age 17, and will adjust for inflation annually. Check out the IRS website to see if you qualify for the CTC.

The “refundable” portion of the tax credit will be $1,700 for 2025, and will adjust for inflation annually.

What does “refundable” mean? It means that even if you owe $0 in taxes, you’ll get a refund worth the amount of remaining credit owed to you. On the other hand, a non-refundable credit means if you owe $0 tax, and there’s no tax for the remaining credit to offset, you won’t be getting a check.

Here’s an example of refundable vs non-refundable.

REFUNDABLE

(1) You owe $1,000 in taxes

(2) You’re entitled to a $1,400 refundable credit

(3) $1,000 worth of tax credit wipes out your $1,000 tax liability

(4) You get a $400 refund.

NON-REFUNDABLE

(1) You owe $1,000 in taxes

(2) You’re entitled to a $1,400 non-refundable credit

(3) $1,000 worth of tax credit wipes out your $1,000 tax liability

(4) You get no refund. The remaining $400 credit is lost because it was non-refundable.

INCOME LIMITS

There are phase-out limits for the CTC. Once you surpass the below income thresholds (based on your tax filing status), the amount of CTC is reduced.

Here’s an example of a couple filing Married Filing Jointly with two eligible children. Their maximum possible CTC is $4,400. For every $1,000 they make over the threshold, the CTC is reduced by $50.

The OBBBA also makes permanent the $500 non-refundable Credit for Other Dependents. This is used when you have dependents who don’t qualify for the standard CTC.

(6) TRUMP ACCOUNTS

Section 70204

Effective for tax year: 2026

Expires after tax year: Permanent

OBBBA has created “Trump Accounts”, which “shall be treated for purposes of this title in the same manner as an individual retirement account under section 408(a).”

I think of this account as a hybrid / quasi-IRA that will certainly require further guidance and clarification from the government.

Trump Accounts become effective in 2026 and contributions can be made after July 4, 2026. The bill specifically states, "No contribution will be accepted before the date that is 12 months after the date of the enactment of this section."

The child must be under age 18 to fund the account. The bill states the account can be funded for any child who, “has not attained the age of 18 before the end of the calendar year." More on post-18 contributions below.

There is no earned income requirement like there is for a custodial Roth IRA.

Contributions are capped at $5,000 per year (adjusted for inflation starting in 2028).

There is no tax deduction for the contribution. Contributing money to a Trump Account will not reduce your taxable income like a contribution to your traditional TSP would.

501(c)(3) charitable organizations and government entities (state, local, and federal) can contribute to the account, and their contribution will not count against the $5,000 limit.

Employers (of the parent or child) can also contribute up to $2,500, which will not be included as income to the employee. From what I can understand right now, it looks like an employer contribution to a Trump Account will count towards the $5,000 annual contribution limit.

There will be a $1,000 contribution by the government for children born 1/1/25 – 12/31/28. The pilot program allocated $410 million until 9/30/34 to help jump-start these accounts. I don't think that original $410 million needs to be allocated until 9/30/34. $410,000,000 divided by $1,000 per child = 410,000 children will benefit. According to the CDC, roughly 3.5 million children are born each year.

No distributions can be taken before the child is 18. The bill states, “no distribution will be allowed before the first day of the calendar year in which the account beneficiary attains age 18.”

Tax on Distributions

There are a lot of conflicting interpretations from very reputable sources as to whether or not the distributions will be taxed as ordinary income or more preferential long-term capital gains. This confusion appears to come from different versions of the bill that were floating around prior to July 4th.

However, from what I can understand in the final version of the bill and have read from other reputable sources, distributions will be taxed as ordinary income, just like a traditional IRA, with the same exceptions to the 10% early-withdrawal penalty (higher education expenses, 1st time homebuyer, age 59.5, disability, death, etc.).

However, there’s a slight complication. Some of the money in the account has already been taxed.

The Trump Account will contain after-tax contributions (“basis” or “principal”), which will be withdrawn tax-free. The account will also contain earnings / growth which has not been taxed yet. So, this means you’ll have a mix of after-tax basis / contributions and pre-tax growth that has to be accounted for and calculated at the time of withdrawal. You cannot just distribute contributions / basis like you can with the Roth IRA ordering rules.

Here's an example of a pro-rata distribution of both pre-tax and after-tax money.

If you have an account balance of $10,000, and $4,000 is original after-tax contribution (tax-free “basis”) and $6,000 is pre-tax growth, you have a 40% / 60% split between tax-free and taxable. If you were to withdraw $1,000, $400 (40%) would be tax-free and $600 (60%) would be taxed as ordinary income.

If they allow a Trump Account owner over age 18 to rollover / transfer their Trump Account to an IRA, they could then move the pre-tax growth to a traditional IRA and the after-tax contributions to a Roth IRA. Or even better, assuming the 18-year-old is in a low tax bracket, they could just convert the entire amount to a Roth IRA and let the tax-free compounding magic begin.

What investments can a Trump Account invest in?

This is my favorite section out of everything I read in the OBBBA. It has nothing to do with politics or taxes, but instead, it aligns with my personal wealth building philosophy.

“Eligible investments” for the Trump Account include:

1. Mutual fund or Exchange Traded Fund (ETF)

2. Tracks the returns of a qualified index

a. Qualified index means: The S&P 500 stock market index or any other index which is comprised of equity (stock) investments in primarily U.S. companies.

b. It shall not include any industry or sector-specific index.

3. Does not use leverage

4. Does not have annual fees and expenses of more than 0.1 %

Whoever wrote this section gets it.

They are forcing these accounts to be invested in low-cost, broadly diversified, passively managed index funds.

No leverage.

No sector tilts (technology, energy, healthcare, finance, etc.).

No fancy triple-leveraged inverse ETF strategy.

No tactics that, "only the rich know".

No high-fee hybrid insurance / investment product invented to make the salesperson rich.

Just boring, inexpensive, easy-to-understand U.S. stock index funds similar to the TSP C Fund, TSP S Fund, or a Vanguard / Fidelity / Charles Schwab Total U.S. Stock Market Index Fund or an S&P 500 fund. *I have no affiliation with these companies, they are simply low-cost custodians that I personally use.

I strongly believe that this style of investing is the most effective and efficient route to building true wealth for the vast majority of people.

There is an argument to be made for more diversification with international stock exposure. Am I a believer in international diversification? Yes. I personally own international stock funds. Does the lack of international stock exposure in Trump Accounts bother me? Not really.

We need to not let perfect be the enemy of good. In fact, in the article I wrote on custodial Roth IRAs a few weeks ago, I said if I had a child and were opening a Roth IRA for them today, I would buy one fund: a total U.S. Stock market index fund. That's it.

There's also the argument that 100% stock exposure may not be appropriate for some individuals depending on their unique goals, risk tolerance, and risk capacity.

However, at the end of the day, the majority of investors will benefit from simplicity, especially minor children with lots of time to let their money compound. This account is not specifically designed for college savings; it's a long-term investment account, which is why it basically morphs into a traditional IRA upon reaching age 18.

If you do want to earmark certain dollars for college and invest them in less volatile assets like bonds, do that within an account that you can control the investments, like a 529 or taxable brokerage account.

I've also seen negative critiques about the 0.1% expense ratio. If your account value is $5,000 and the expense ratio is 0.1%, you'll pay $5 in fees that year. If you continue to contribute $5,000 per year, for 18-years, and earn 8% return, the total fees paid over those 18-years will be $2,472.71.

Are there cheaper equivalent funds at the major custodians? Absolutely. The Vanguard S&P 500 ETF (VOO) has an expense ratio of 0.03% (*this is simply an example and is not an investment recommendation). In the example above with $5,000 per year for 18-years and an 8% return, your total fees with VOO would be $744.99.

Do I like the VOO fee more than the Trump Account's mandated 0.1% or less? You bet. Saving $1,728 in fees is a win in my book. However, is 0.1% egregious? Not even close. I've seen private sector 401(k), 403(b), and 457(b) accounts with much higher fees for basic index funds. We're talking 5-10x more expensive than VOO for a passive index fund. That's highway robbery.

Warning - After the beneficiary turns age 18, they can invest in other options just like a regular IRA. This means they could invest in the forbidden items above. The only things they can not invest in, within the Trump Account, regardless of age, are the IRA prohibited investments: (1) life insurance, (2) collectibles, (3) S-corporation stock, and (4) property used by them personally / "self-dealing".

Post-18 Contributions - According to the nationally recognized IRA expert Ed Slott, once the minor turns age 18, contributions will still be allowed, however they will follow the regular traditional IRA contribution rules.

This means that the traditional IRA contribution limits would apply to the Trump Account ($7,000 in 2025). It also means that the ability to deduct that contribution would be determined by the same IRS rules that apply to traditional IRA deductibility: (1) Modified Adjusted Gross Income (MAGI) and (2) whether the account owner and / or their spouse are covered by an employer retirement plan.

Trump Accounts & IRAs – Contributing to a Trump Account will not count against the contribution limits for IRAs. Trump Accounts are not included for IRA aggregation purposes. As of right now, it appears that you will not be allowed to rollover / transfer these accounts into each other.

Death of a child – Similar to an HSA passed to a non-spouse beneficiary upon the death of the owner, when the child beneficiary of a Trump Account dies, “such account shall cease to be a Trump account as of the date of death.” This means the fair market value of the account (minus after-tax basis / "investment in the contract") will be taxable to the beneficiary or the estate.

(7) 529 PLANS

Section 70413

Effective for tax year: (1) The new qualified expense provision is effective for 529 distributions taken after 7/4/25. (2) The new $20,000 K-12 expense limit starts in 2026.

Expires after tax year: Permanent

529 plans are traditionally used to save for a child’s education-related expenses, however, they are not limited to children. I have two in-depth articles on education funding options here (529s) and here (other non-529 options).

Any U.S. resident, age 18+ can open a 529 and contribute after-tax money for a beneficiary. The 529 beneficiary does not have to be a child or a relative. There are no income limits to contribute. The money can be invested in stocks, bonds, or mutual funds, just like an IRA. Depending on your individual state rules, you may get a tax deduction for contributions. The money grows tax-free / deferred and can be withdrawn tax-free for “qualified education expenses”.

529 withdrawals are generally exempt from both federal and state tax, when used for qualified education expenses.

Prior to OBBBA, the maximum amount of K-12 eligible expenses that could be paid for with 529 funds was $10,000, and the only eligible education expense was tuition. OBBBA changes both of these limitations.

Starting in 2026, the amount that can be withdrawn from a 529 for K-12 eligible expenses will increase to $20,000.

OBBBA also adds new expenses that qualify as education expenses connected to enrollment or attendance at an elementary or secondary public, private, or religious school. 529 funds can be distributed for these new qualified expenses after July 4, 2025.

New eligible education expenses include:

(A) Tuition.

(B) Curriculum and curricular materials.

(C) Books or other instructional materials.

(D) Online educational materials.

(E) Tuition for tutoring or educational classes outside of the home, including at a tutoring facility, but only if the tutor or instructor is not related to the student and-

(i) is licensed as a teacher in any State,

(ii) has taught at an eligible educational institution, or

(iii) is a subject matter expert in the relevant subject.

(F) Fees for a nationally standardized norm-referenced achievement test, an advanced placement examination, or any examinations related to college or university admission.

(G) Fees for dual enrollment in an institution of higher education.

(H) Educational therapies for students with disabilities provided by a licensed or accredited practitioner or provider, including occupational, behavioral, physical, and speech-language therapies.''.

Still 529...

Section 70414

Effective for tax year: Distributions from 529s taken after 7/4/25

Expires after tax year: Permanent

The bill also allows tax-free 529 withdrawals for “postsecondary credentialing expenses”. This would include tuition, fees, books, continuing education, and exam costs to obtain a credential.

(8) AGE 65 BONUS DEDUCTION / EXEMPTION

Section 70203

Effective for tax year: 2025

Expires after tax year: 2028

If you’re going to be at least age 65 by the end of the year*, or plan on helping someone age 65+ with their taxes, you/they may be eligible for a “bonus” deduction / exemption on top of the standard deduction, which is already increased by the age 65+ “additional deduction”.

Clear as mud, right?

*One bizarre caveat about "being" at least age 65 by the end of the year. This will not apply to many people, but it's worth mentioning for the one-off scenario.

If you were born on January 1, 1961, you are technically considered to be age 65 at the end of 2025, even though you won’t be 65 until 1/1/2026. Yes – this is how it really works. Check out IRS Topic No. 551 and IRS Publication 501 which states, “You are considered 65 on the day before your 65th birthday. Therefore, you can take a higher standard deduction for 2024 if you were born before January 2, 1960” (for tax year 2024).

So, putting the abacus aside, what deductions / exemptions can the age 65+ crowd get?

Those age 65 and older are eligible for:

(1) The standard deduction (single: $15,750 / married filing jointly: $31,500)

(2) The additional deduction, which in 2025 is:

-$2,000 (single filers and joint filers with only ONE spouse age 65+) or

-$1,600 each for married filers where BOTH spouses are age 65+ ($3,200 total)

(3) The OBBBA bonus deduction / exemption, which in 2025 is:

-$6,000 (single filers and joint filers with only ONE spouse age 65+) or

-$6,000 each for married filers where BOTH spouses are age 65+ ($12,000 total)

The below table should help clear this up.

INCOME PHASE-OUT

The $6,000 bonus deduction does phase-out once Modified Adjusted Gross Income (MAGI) reaches $75,000 (single) or $150,000 (MFJ).

The bonus deduction is reduced by 6% of the amount of income over the threshold.

Single filers with MAGI at / above $175,000 get $0 bonus deduction.

Couples filing MFJ (regardless of whether one or both spouses are age 65+) with MAGI at / above $250,000 get $0 bonus deduction.

MFJ filers where BOTH spouses are age 65+ will have their separate $6,000 bonus deductions phased-out at the same time by the same income.

So, let’s take a couple who are both over age 65 and therefore have a possible bonus deduction of $12,000. If their income is $250,000, they (as a joint tax unit) have exceeded the threshold by $100,000. 6% of $100,000 is $6,000. So, BOTH of their $6,000 deductions are reduced by $6,000, leaving them with $0 bonus deduction.

This "bonus" deduction is technically an exemption, which generally functions the same as a “below-the-line” deduction, meaning it will still reduce taxable income, but won't reduce Adjusted Gross Income (AGI) on line 11 of the 1040. This means that other tax triggers centered around AGI (e.g., deductible medical expenses, Medicare Part B premiums, taxation of Social Security, traditional IRA deductibility, etc.) won't be affected by this exemption.

(9) CAR LOAN INTEREST DEDUCTION

Section 70203

Effective: 2025

Expires: 2028

If you have an auto loan on an “applicable passenger vehicle” used for personal use, you may be able to deduct a portion of the loan interest for tax years 2025 – 2028.

The maximum deductible interest is $10,000 annually.

You do not have to itemize deductions on Schedule A to take advantage of this deduction.

The “applicable passenger vehicle” must:

Be a new vehicle (purchased after December 31, 2024).

Not be leased, a fleet vehicle / commercial use, or purchased for salvage or scrap.

Have at least two wheels.

Be a car, minivan, van, sport utility vehicle, pickup truck, or motorcycle (no ATVs).

Have a gross vehicle weight rating of less than 14,000 pounds.

Have had “final assembly” in the United States. Final assembly is not defined other than: “the process by which a manufacturer produces a vehicle at, or through the use of, a plant, factory, or other place from which the vehicle is delivered to a dealer with all component parts necessary for the mechanical operation of the vehicle included with the vehicle, whether or not the component parts are permanently installed in or on the vehicle.”

There are deduction phase-outs once income reaches $100,000 (single) and $200,000 (MFJ). The reduction is $200 for every $1,000 above the threshold.

Single filers can deduct $0 once income reaches $150,000.

Married Filing Jointly filers can deduct $0 once income reaches $250,000.

The VIN must be included on your tax return.

This $10,000 interest amount and the income thresholds are a bit of a head-scratcher.

In order for someone making $100,000 worth of income to deduct the full $10,000 loan interest, they would have to have a car loan of roughly $181,000.

Let’s break it down.

Loan amount: $181,000

Term: 60-months / 5-years

Interest: 6%

Monthly Payment: $3,499.24

I really hope there isn’t someone making $100,000 or less thinking about getting that shiny new car and a giant loan to “write off” $10,000 worth of interest (if you haven’t seen this Schitt's Creek scene, it’s a must). Remember, a tax deduction is not a dollar-for-dollar offset like a tax credit.

The auto loan interest deduction is a “below-the-line” deduction, meaning it will still reduce taxable income, but won't reduce Adjusted Gross Income (AGI) on line 11 of the 1040. This means that other tax triggers centered around AGI (e.g., deductible medical expenses, Medicare Part B premiums, taxation of Social Security, traditional IRA deductibility, etc.) won't be affected by this deduction.

(10) CHARITABLE CONTRIBUTION DEDUCTION

Section 70424 & 70425

Effective: 2026

Expires: Permanent

Starting in 2026, you can deduct $1,000 for charitable contributions (single) or $2,000 (Married Filing Jointly), even if you take the standard deduction and do not itemize deductions on Schedule A. In fact, if you do itemize, there’s a catch (explained below).

26 U.S. Code § 170(p) confirms that the donation must be monetary (cash, checks, credit / debit card payments, ACH transfers, etc.). Clothes, books, your least-favorite child, other items donated to Goodwill do not count.

The amount of cash donations to a public charity which you can deduct is typically limited to 60% of your Adjusted Gross Income (AGI). There are different rules for non-cash donations and non-public charities.

Don’t make a donation to save money. Make a donation because you want to donate to a charity you support. If you make a qualified charitable contribution worth $1,000 and you’re in the 24% marginal federal tax bracket, you would save $240 in tax. Yes, you saved $240, but you’re still net negative $760. This is not a dollar-for-dollar off-set.

There are no income phase-outs for this charitable contribution deduction.

This is a “below-the-line” deduction, meaning it will still reduce taxable income, but won't reduce Adjusted Gross Income (AGI) on line 11 of the 1040. This means that other tax triggers centered around AGI (e.g., deductible medical expenses, Medicare Part B premiums, taxation of Social Security, traditional IRA deductibility, etc.) won't be affected by this deduction.

You do not have to itemize deductions on Schedule A to take advantage of this deduction.

Itemized Deductions

For those who do itemize on Schedule A vs. taking the standard deduction, there is now a floor for your charitable deductions. The floor is 0.5% of Adjusted Gross Income.

This means only the amount of your charitable contribute ABOVE 0.5% of your AGI can be deducted.

So, if your AGI is $100,000, the floor is $500. (0.5% x $100,000). Charitable contributions ABOVE $500 can be added to your itemized deductions. Donate $1,000, deduct $500 on Schedule A.

Closing

That's it for now. These are the top 10 provisions from the OBBBA that I could see affecting a large swath of federal employees. Love the bill or hate it, the OBBBA will affect your financial and tax picture. With this being newly passed, I expect further clarification and guidance on some of the cloudier provisions.

About the Author

Tyler Weerden is a fee-only financial planner and the owner of Layered Financial, a Registered Investment Advisory firm based in Arlington, Virginia. In addition to being a financial planner, Tyler is a full-time federal agent. He holds a Bachelor of Science degree, a Master of Science degree, passed the Series 65 exam, and is a Certified Fraud Examiner (CFE). Tyler is the sole Investment Adviser Representative at Layered Financial.

Prior to becoming a federal agent, Tyler served as a state trooper, local police officer, and was a member of the U.S. Army National Guard. He has served in both domestic and overseas Foreign Service assignments. Tyler has experience with local, state, and federal pension systems, 457(b) Deferred Compensation, the federal Thrift Savings Plan (TSP), Individual Retirement Accounts (IRAs), Health Savings Accounts (HSAs), and various investment options to include rental real estate.

Disclaimer

Layered Financial is a Registered Investment Adviser registered with the Commonwealth of Virginia and State of Texas. Registration does not imply a certain level of skill or training. The views and opinions expressed are as of the date of publication and are subject to change. The content of this publication is for informational or educational purposes only. This content is not intended as individualized investment advice, or as tax, accounting, or legal advice. Nothing in this article should be seen as a recommendation or advertisement. Layered Financial and its Investment Advisor Representatives have no third-party affiliations and do not receive any commissions, fees, direct compensation, indirect compensation, or any benefit from any outside individuals or companies. Although we gather information from sources that we deem to be reliable, we cannot guarantee the accuracy, timeliness, or completeness of any information prepared by any unaffiliated third-party. When specific investments, types of investments, products, or companies are mentioned, such mention is not intended to be a recommendation or endorsement to buy or sell the specific investment, solicit the business, or use that product. The author of this publication may hold positions in investments or types of investments mentioned in articles. This information should not be relied upon as the sole factor in an investment-making decision. Readers are encouraged to consult with professional financial, accounting, tax, or legal advisers to address their specific needs and circumstances.

© 2025 Tyler Weerden. All rights reserved. This article may not be reproduced without express written consent from Tyler Weerden.